Some Known Details About Estate Planning Attorney

Table of ContentsUnknown Facts About Estate Planning AttorneyTop Guidelines Of Estate Planning AttorneyAll About Estate Planning AttorneyExcitement About Estate Planning Attorney

Estate preparation is an activity strategy you can make use of to establish what happens to your possessions and obligations while you live and after you pass away. A will, on the various other hand, is a legal paper that details just how assets are distributed, that deals with children and family pets, and any type of various other desires after you die.

The administrator likewise has to pay off any type of tax obligations and financial debt owed by the deceased from the estate. Lenders usually have a minimal quantity of time from the day they were notified of the testator's fatality to make cases against the estate for money owed to them. Insurance claims that are denied by the executor can be taken to court where a probate judge will certainly have the last say as to whether or not the claim stands.

Excitement About Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of possessions computed, and taxes and financial obligation repaid, the executor will certainly after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of estate tax obligations that are pending will come due within 9 months of the date of death.

Each individual locations their possessions in the count on and names somebody aside from their spouse as the beneficiary. Nonetheless, A-B trusts have become much less preferred as the estate tax exemption functions well for the majority of estates. Grandparents might transfer assets to an entity, such as a 529 plan, to sustain grandchildrens' education and learning.

The Best Strategy To Use For Estate Planning Attorney

Estate planners can collaborate with the donor in order to lower taxable revenue as a result of those payments or formulate techniques that make best use of the impact of those donations. This is one more strategy that can be utilized to restrict death tax obligations. It entails a private locking in the present worth, and thus tax responsibility, of their residential or commercial property, while connecting the value of future growth of that resources to another person. This approach entails cold the worth of a property at its worth on the day of transfer. Accordingly, the quantity of possible funding gain at fatality is also iced up, enabling the estate organizer to approximate their potential tax liability upon death and much better prepare for the settlement of income taxes.

If go to this website adequate insurance policy proceeds are available and the policies are appropriately structured, any kind of revenue tax obligation on the deemed personalities of assets following the death of an individual can be paid without turning to the sale of possessions. Earnings from life insurance policy that are obtained by the beneficiaries check upon the death of the guaranteed are usually revenue tax-free.

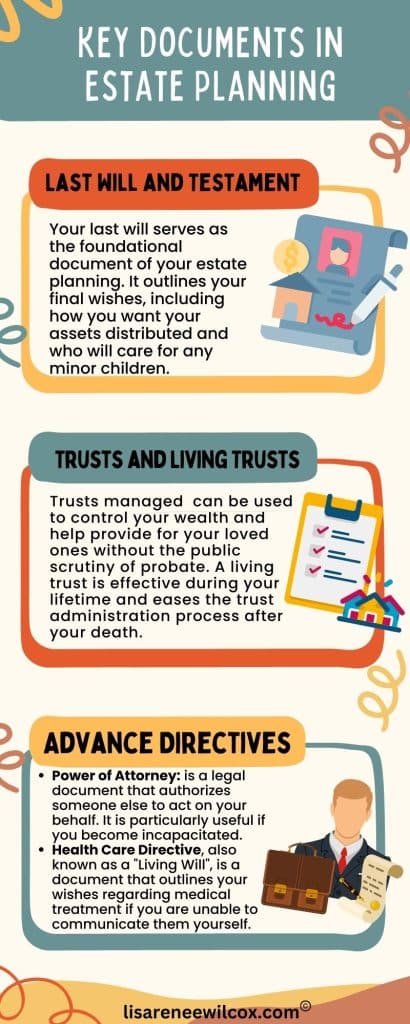

There are specific papers you'll require as part of the estate planning procedure. Some of the most typical ones consist of wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth people. That's not real. Estate preparation is a device that everybody can use. Estate planning makes it less complicated for people to identify their wishes prior to and after they pass away. In contrast to what a lot of people think, it expands past what to do with assets and liabilities.

Estate Planning Attorney Can Be Fun For Everyone

You must begin intending for your estate as soon as you have any type of measurable asset base. It's an ongoing procedure: as life proceeds, your estate plan ought to move to match your conditions, in line with your new goals.

Estate preparation is often thought of as a device for the wealthy. Estate preparation is additionally a great way for you to lay out strategies for the treatment of your small kids and family visit pets and to describe your desires for your funeral and favorite charities.

Qualified candidates that pass the test will be officially licensed in August. If you're qualified to rest for the test from a previous application, you may file the short application.